The idea of telemedicine (also known as telehealth) isn’t something new and it’s been around for many decades starting out in distant villages of Africa as a single way for patients to get any medical help at all. In the last 15 years telehealth has been successfully implemented in 12 countries. It is most developed, however, in the USA and EU.

The main purpose of telemedicine is to eliminate time loss when a patient often has to spend a few hours getting to a doctor’s office and waiting in line among other sick people in case of emergency or in seek of a second opinion. On the other hand, by reaching a medical specialist remotely everyone benefits in terms of costs. In addition, with telehealth technologies busy doctors can easily be part of medical educational programs aimed at increasing their expertise, as well as consult with their peers without having to travel elsewhere or pay extra fees – it is always cheaper online.

In 2014, the global telehealth technologies market including software, hardware and services was assessed at $17.8 billion and predicted to grow at a compound annual growth rate of 18.4% by 2020. As of now, over 800,000 online consultations have been held all over the United States, according to MedCityNews.

According to multiple studies held in 2015, the fastest growing telemedicine technology is now in the USA whereas European market of eHealth faces a few obstacles. Among them are unclear regulations on reimbursement policies in a public sector and generally immature telehealth market with personal consultations preferred in the majority of cases, and just a few eHealth providers partnering with leading online payment companies. At the same time in the USA this past year has shown serious increase of video, phone and text consultations. This occurs probably thanks to the fact that American healthcare system covers telemedicine reimbursement and generally doesn’t cause any difficulties in its actual realization whenever it’s required. It also helps both patients and doctors avoid insurance hassle.

Even though the American telemedicine market is rapidly developing, in 2015 it is still being limited by a number of concerns, with major issues lying in inflexible working conditions for doctors who are only allowed to charge a certain fee and work at a certain time-frame. Patient data security is another critical issue preventing telehealth from going mainstream.

That’s where free market system stands out! One of US leading telehealth providers, Video Medicine is already exploiting the unlimited abilities of telemedicine with their new HIPAA compliant platform solution. Since data security is essential for this type of technology, it’s even exceeding HIPAA requirements - all the private patient data is encrypted and anonymous mode is available. It doesn’t only allow practitioners to choose their own rates and schedule, but also provides:

- excellent connectivity globally

- robust features for patients with hearing disabilities

- the ability to send and receive high-resolution images during a call for clear demonstration of different health problems to a medical specialist.

The system has very strict doctor selection policy and allows selected physicians to increase their income and deal less with insurance routine while gaining new patients and keeping the existing ones. The application works on any mobile device supporting Android or iOS, which makes it accessible for the majority of potential users. Interestingly, the app works pretty well outside the United States, outrunning its European competitors and drawing their interest to the American eHealth products.

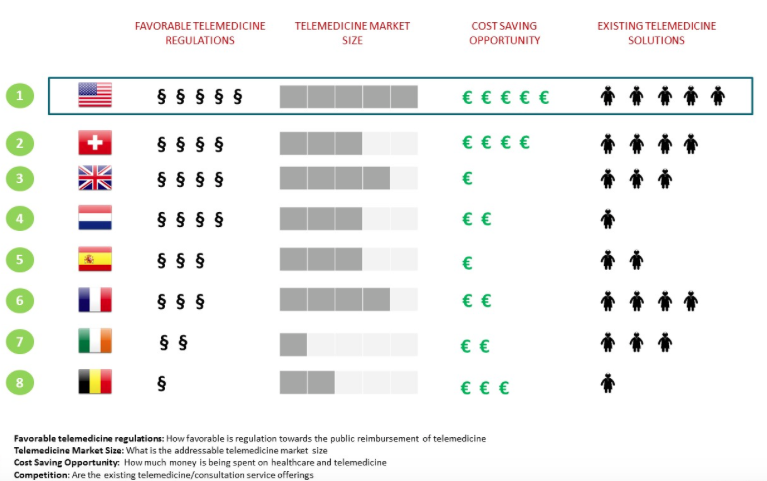

Now let's review the main factors that define the market conditions for telemedicine services:

1. Regulations and policies

The USA has embedded telehealth regulation in their Medicare program which allows for reimbursement Health Professional Shortage Areas and in states outside the Metropolitan Statistical Area. Of all the EU countries surveyed by research2guidance in 2015, the Netherlands alone can boast best reimbursement coverage of telemedicine. Remote / virtual consultations are common practices for which Dutch doctors are reimbursed by Holland InterCare (HIC) via fixed prices. However, the Dutch telemedicine has a lot of restrictions: for instance, insurance reimbursements only cover tele-dermatology and email consultations, while face-to-face consultation is required to be established between a physician and a patient prior to employing telemedicine.

2. Size of the target market

In the EU, most of telemedicine services are provided by the national public healthcare system. Given the lack of public reimbursement, the target market is comprised of the two elements: size of population and the number of privately insured people as private medical insurers usually provide telemedicine services as a complimentary service. As such, the United Kingdom appears to be the most prospective market for telehealth in Europe as its population exceeds 65 million of whom 14% are privately insured.

In general, EU countries with high healthcare spending per capita and a large proportion of rural population (e.g. Switzerland) are ideal target markets for remote / mobile consultation services.

3. Cost saving and income increase opportunities

One of the key benefits promised by telehealth is the ability to reduce cost of hospital visits for patients, especially those living in rural areas. Yet, all stakeholders should be satisfied to get a buy-in for telemedicine adoption. As mentioned above, in most cases physicians are only permitted to set certain rates for video consultations with patients. For instance, American telemedicine platform MDLive that was not so long ago integrated in Walgreens application charges $49 per a 10-15 minute video consultation. In case of VideoMedicine solution, doctors can set own rates per minute of consultation and, thus, increase their earning. Let's say a patient only needs to briefly chat with a doctor that charges $1.50 / minute at day time and $3 / minute in the evening. In this case, the patient will not have to pay $49 for a 3-5 minute chat which can eventually result in significant cost saving.

4. Competition

The emergence of innovative telemedicine platforms globally such as VideoMedicine, MeeDoc, Health Tap, etc shows clearly that this early-stage market is moving towards a much more favorable environment.

Telemedicine Maturity of 7 EU Countries Compared To the USA, source: research2guidance

In Europe, Switzerland is ahead of the curve when it comes to telehealth adoption. This is due to the following reasons:

- the same laws apply for telehealth as for face-to-face consultations;

- the high number of privately insured people;

- strong telemedicine service offering (e.g., Medgate claims to be the largest telemedicine provider in the whole Europe and is currently partnered with more than a dozen online payment providers).

Some of the successful US telehealth system providers are already looking beyond the national borders in their pursuit of the market share. For instance, VideoMedicine will have been localized and deployed in Italy and China in the first half of 2016.